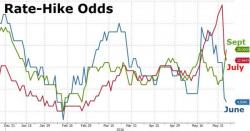

Treasuries Slump After Foreign Buyers Flee From Mediocre, Tailing 2 Year Auction

One look at today's repo market levels before today's 3 Year auction would have suggested that just because 3 Year paper was trading special in repo, that we would be primed for another short squeeze.

However, that did not happen. Instead, and contrary to last month's stellar 3 Year auction, moments ago the US Treasury reported that today's auction printed at a high yield of 0.93%, tailing the When Issued 0.928% by 0.2 bps, and 5.5bps higher than last month's 0.875%.