Stocks Surge To 11-Month Highs (Then Drop) On Lowest Volume Day Of 2016

To sum up today: "Investors" bought stocks, bonds, gold, oil, Yen, Loonies, Iron ore, high yield bonds... and VIX?

To sum up today: "Investors" bought stocks, bonds, gold, oil, Yen, Loonies, Iron ore, high yield bonds... and VIX?

There was much excitement last month when the Fed reported that in March consumer credit soared by the highest in years, rising by $28 billion, and smashing expectations, on the back of a near record $10.4 billion surge in revolving, aka credit card, credit. It appears that this may have been a "one-time" event, because according to the latest report, in April, consumer credit rose by less than half of its March total notional, increasing by only $13.4 billion, well below the $18 billion expected.

Submitted by Lance Roberts via RealInvestmentAdvice.com,

As I discussed in this past weekend’s commentary:

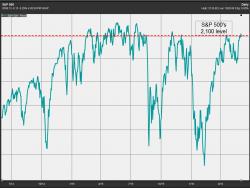

“With the market now overbought on a WEEKLY basis, there is little “fuel in the tank” effectively to substantially drive prices higher in the short-term. Therefore, with risk outweighing reward at the moment, a more cautious stance to portfolio management should be considered.

After embattled Lending Club was briefly halted as it postpones today's shareholder meeting until June 28th because it is "not yet in a position to report on the state of the company," the stock is trading down 5% as the desperate (for investors) lender decides to raise prices (interest rates) in this case for borrowers (and tighten up lending standards).

So a triple whammy... Postponed Annual Shareholder Meeting...

Submitted by David Stockman via Contra Corner blog,

Whatever is going on in the daily stock market, you can’t call it “price discovery” or even remotely rational.

In fact, it amounts to grinding in harms’ way, and measures the degree to which the Fed and other central banks have turned the Wall Street casino into a giant litter of sick puppies who are bent on rolling the dice until they self-destruct.