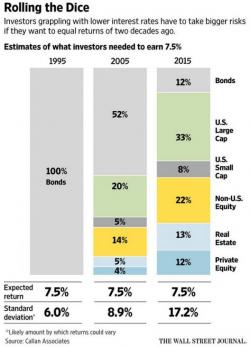

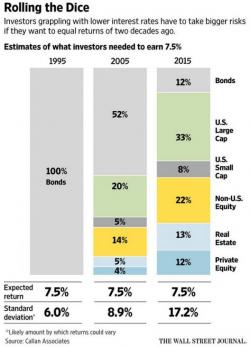

Welcome To The New Normal, Where 3x More Risk Gets You The Same Returns As Twenty Years Ago

As we touched upon earlier, central banks have created an unprecedented disaster for investors and savers alike.

As we touched upon earlier, central banks have created an unprecedented disaster for investors and savers alike.

With regulators and local authorities unable or unwilling to crack down on the unprecedented housing bubble in select Canadian cities, increasingly used by Chinese oligarchs to park hot cash offshore, the local banks are starting to take action into their own hands. Case in point, Bank of Nova Scotia has decided to ease off on mortgage lending in Vancouver and Toronto due to soaring prices, Chief Executive Officer Brian Porter said.

Having previously explained how China's hard landing has begun, former ABN AMRO chief investment stratgist Richard Duncan warns of a "severe and protracted" slump is ahead as "this enormous gap between investment and consumption means China’s economy is now wildly unbalanced."

Duncan has published a series of videos explaining why, in his opinion, China’s economic development model of export-led and investment-driven growth is now in crisis.

Nearing the end of his presidency, glorious leader Obama came out today in what was hailed his "economic victory lap."

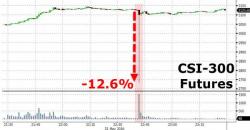

Seemingly missed by the mainstream media on Monday, Chinese equity futures crashed over 12.5% - the biggest drop since 1995 - only to soar back to unchanged within seconds. This was not a 'fat-finger' trade, and as one trader noted, "liquidity in the market is really thin right now," which is borne out by the evidence.