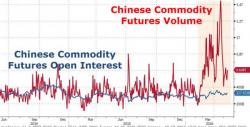

Chinese Commodity Carnage Unwinds Entire Bubble - Steel Futures Crash Most Since 2009

Well that de-escalated quickly...

As Reuters reports,

Chinese steel futures were on course for their biggest weekly fall since 2009 on Friday, as a selloff in the country's commodities showed signs of spreading to other global markets for raw materials such as palm oil and base metals.