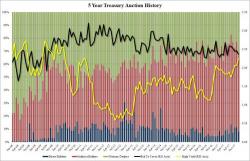

Demand Tumbles For 5Y Treasuries As Tailing Auction Leads To Highest Yield Since 2011

After yesterday's ugly, tailing 2-Year auction, it is probably not a big surprise that today's sale of $34 billion in 5Y Treasurys was just as ugly.

The auction printed at a high yield of 2.245% - the highest since March 2011 - and well above last month's 2.066% largely thank to the recent Fed rate hike. More troubling is that the auction tailed the When Issued 2.228% by a whopping 1.7bps, the biggest tail going back at least 2 years.