The Coming War Of Central Banks

Submitted by Charles Hugh-Smith of OfTwoMinds blog,

Welcome to a currency war in which victory depends on your perspective.

Submitted by Charles Hugh-Smith of OfTwoMinds blog,

Welcome to a currency war in which victory depends on your perspective.

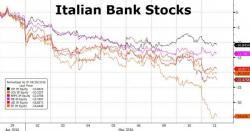

Banco Popolare is dragging the rest of the Italian banking system drastically lower today after a "susprise" Q1 loss driven by soaring bad loan writedowns. Banco Popolare is down 14% on the day (25% in a week) to a record low, as Reuters reports the bank was forced to admit the reality of its bad loans by the European Central Bank as a condition for approving a planned merger with Banca Popolare di Milano that will create Italy's third-biggest banking group.

A week in the life of Italian banks... bloodbath...

We were amused to report early on Monday that just as oil was trading within pennies of $46 and set to tumble, while US equity futures were about to commence their biggest two day gain in two months, none other than Dennis Gartman chimed in with yet another can't miss "prediction" when he said that "it is time to buy crude oil and to sell equity futures, with the only problem now to decide how to weight the position."

The retailer apocalypse continues this morning with Macy's crashing almost 10% in the pre-market after missing top-line and slashing its outlook citing the "uncertain direction of consumer spending," which seems odd given the confidence with which The Fed, Obama, and every talking head proclaims the US consumer's health. Comp store sales plunged 6.1% (almost double expectations) and this comes at a time when clothing inventories are at an all-time record high relative to sales.

It was just last week when legendary hedge fund manager Stanley Druckenmiller delivered his latest anti-Fed sermon and once again extolled gold as the asset class to own in these experimental times in which the "bull market in stocks is exhausted", saying "what was the one asset you did not want to own when I started Duquesne in 1981? Hint…it has traded for 5000 years and for the first time has a positive carry in many parts of the globe as bankers are now experimenting with the absurd notion of negative interest rates.