Stocks Dump, Bonds Jump As Retail Wreckage Trumps Crude Spike

Remember how awesome it all felt yesterday, yeah that's all gone... Pride (in senseless uncorrelated low volume rallies) always comes before the fall...

Remember how awesome it all felt yesterday, yeah that's all gone... Pride (in senseless uncorrelated low volume rallies) always comes before the fall...

Via Dana Lyons' Tumblr,

Oil stocks are at a seemingly “must-hold” level within their long-term reversal attempt.

Over the past two weeks we observed two curious, vol-related phenomena.

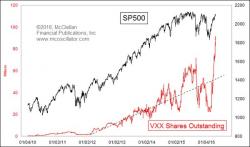

First, it was Tom DeMark cautioning that even as stocks have surged, the amount of VXX shares outstanding has soared to record highs, a seemingly contradictory confluence of events because it suggested that investors, traditionally "going with the market flow", are betting on a major vol reversal and furthermore the move contradicts historical shifts in VXX holdings at times of extreme market upside.

By Richard Breslow, a former FX trader and fund manager who writes for Bloomberg

Monetary Policy as a Weapon of Mass Destruction

"A man’s gotta do what a man’s gotta do" has negative connotations. And for good reason. It suggests resignation, lack of any choice or simply the absence of care for the consequences. The forced grasp for yield in today’s markets very much brings the phrase to mind. Investment managers across the board are repeatedly compelled to chase it at painfully bad levels.

If yesterday's 3Y auction was impressive, and stopped well through the When Issued (as hinted by the negative repo rate), today's 10Y was an absolute blockbuster, stopping a whopping 2 bps through the 1.73% When Issued - the biggest stop through since September 2013 - on a yield of 1.71%, the lowest yield since December 2012.