Biotech-Buying Spree Helps Stocks Shrug Off China Crash, Commodity Collapse, & Credit Crunch

There is some serious turmoil going on in credit, commodities, and FX.. but stocks shurugged it all off because jobs were shitty enough to warrant a bid??

There is some serious turmoil going on in credit, commodities, and FX.. but stocks shurugged it all off because jobs were shitty enough to warrant a bid??

Submitted by Lance Roberts via RealInvestmentAdvice.com,

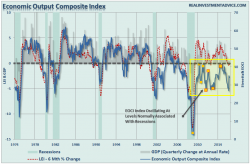

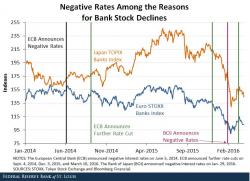

Commercial bankruptcies are skyrocketing, oil prices have collapsed, profits have declined and Central Banks globally are pushing negative interest rates in hopes of keeping economies afloat. At any other point in history, such a combination of events would have investors scrambling for cover as market prices fell.

The following brief comment by Morgan Stanley's chief FX strategist Hans Redeker is one of the best summaries of the sad state the centrally-planned world finds itself in after 7 years of constant central bank manipulation to push risk assets higher no matter the cost.

A few years ago we asked why anyone would exclude litigation charges from bank EPS. While we are still waiting for someone to explain that to us, we'd like to show an update on just how dilutive to shareholder value these "one-time, non-recurring" litigation charges have been over the past six years.

"At the end of the day, negative interest rates are taxes in sheep’s clothing. Few economists would ever claim that raising taxes on households will stimulate spending. So why would they think negative interest rates will?" Those are the shocking words of St.Louis Fed Director of Research Christopher Waller whose brief note today will be required reading for everyone at The Bank of Japan, The ECB and every other central banker on the verge of NIRP...