Global Bond Rout Eases As Nervous Traders Watch For "Selling On The Tax News", Catalan Vote

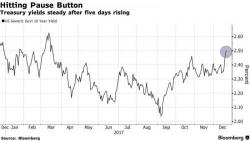

U.S. equity futures are little changed with the GOP Tax Plan now a done deal and no more daily "pricing in" of tax reform possible, as traders nerviously look to see if others will now be "selling the news", a preview of which we got yesterday when US equity indexes closed red across the board despite Trump's biggest legislative win to date, while bonds were spooked by the blowout in government debt needed to fund the giveaways.