"Nothing Has Been Fixed" - Citi's Five Reasons Why This Sucker Is Going Down

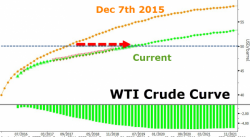

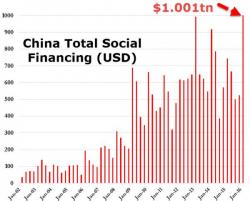

As a result of the dramatic surge in the S&P500 from its February lows, which erased the worst ever start to a year, and nearly regained the all time highs in the US stock market on a combination of a central bank scramble to reflate, the "Shanghai Accord", and the most violent short squeeze in history, coupled with a historic credit injection by China which as we first reported amounted to a record $1 trillion in just the first three months of the year...

... economists have shelved discussions about the threat of a US recession.

That is a mistake.