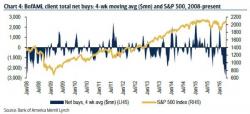

"This Has Been The Longest Selling Streak In History" - 'Smart Money' Sells For Record 14 Consecutive Weeks

When yesterday Bank of America presented "Another Sign That Wall Street Doesn’t Believe The Rally" noting that its "Sell Side Indicator, a measure of Wall Street’s bullishness on stocks, fell by 1ppt to 51.9, its lowest level in over a year" it tried to spin this "pervasive bearishness as a 'reliable contrarian indicator'." Alas, for now it is merely an indicator of precisely what it is: that the smart money still refuses to believe the rally, and following a record 13 weeks of smart money selling, overnight BofA reported what is now becoming painfully farcical: