The Energy Junk Bond Default Rate Just Hit An All Time High

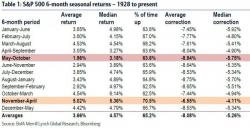

When we last looked at the soaring default rate among junk bonds issuers just two weeks ago, we noted that the $14 billion in defaults had already pushed the April total to the highest since 2014, while the first quarter was the fifth highest quarterly default total on record.

But it was the stark deterioration within the energy space that we said would promptly push high yield bond defaults within the troubled sector to hit all time highs in very short notice.