Why Bill Gross Thinks Helicopter Money Is Imminent: "Politicians & Bankers Will Choose To Fly Instead Of Die"

By Bill Gross Of Janus Capital

Culture Clash

By Bill Gross Of Janus Capital

Culture Clash

In a surprising development, the U.S. monthly international trade deficit decreased substantially in March 2016 from $47.0 billion in February (revised) to $40.4 billion in March, below the $41.2 billion expected, as exports declined by a modest $1.5 billion, a 0.9% drop to $176.62BN from $178.16BN in Feb. At the same time imports outright plunged by $8.1 billion, down 3.6% in March to $217.06BN from $225.13BN in Feb. Curiously this happened just as Canada announced a trade deficit of C$3.4 billion, the widest on record.

Despite a very modest beat of expectations US worker productivity fell for the 2nd quarter in a row (down 1.0% vs 1.3% QoQ), the two-quarter-average output per hour isdown 1.4% - the worst slump since 1993. Unit labor costs rose by a better than expected 4.1% (helped by a downwardly revised 2.7% rise in Q4), the highest since Q4 2014.

America’s productivity slump is the biggest in nearly a quarter century...

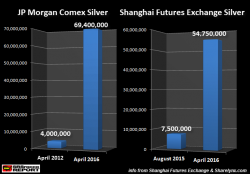

Silver Bullion Market Has Key New Player – China Replaces JP Morgan

The silver bullion market has a key new player – Enter the Dragon. The Shanghai Futures Exchange in China is replacing JP Morgan bank and its clients as the most significant new source of demand according to a very interesting blog with some great charts and tables published by SRSrocco Report yesterday.

According to the report:

Authored by Steve H. Hanke of The Johns Hopkins University. Follow him on Twitter @Steve_Hanke.

A few weeks ago, the Monetary Authority of Singapore (MAS) sprang a surprise. It announced that a further nominal appreciation of the Singapore dollar would not be in the cards. Many interpreted this as a currency war maneuver (read: competitive devaluation) intended to promote exports.