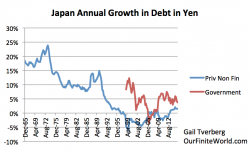

Debt: The Key Factor Connecting Energy & The Economy

Submitted by Gail Tverberg via Our Finite World blog,

Submitted by Gail Tverberg via Our Finite World blog,

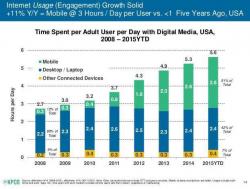

The US became an unsustainable service sector based economy from the 1970s onward when service sector employment diverged from manufacturing without a corresponding boost in productivity. Even Alan Greenspan has warned that America is "in trouble basically because productivity is dead in the water..." There are numerous reasons for this plunge in worker-productivity, from perverted inventives not to work to unintended consequences of monetary policy enabling zombies, but perhaps the most critical driver is exposed in the following dismal chart...

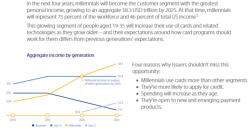

For anyone concerned that $800 billion in student loans over the last decade simply won't be enough debt burden for millennials to carry, worry no more, a solution has been found.

$800 billion in new student loans in the past decade but aside from that "consumers are deleveraging" pic.twitter.com/MwaWby89H4

— zerohedge (@zerohedge) May 2, 2016

Submitted by Pater Tenebrarum via Acting-Man.com,

Damned If You Do…

After waking up on Thursday, we quickly glanced at the overnight market action in Asia and noticed that the Nikkei had tanked rather noticeably. Our first thought upon seeing this was “must be the yen” – and so it was:

June yen futures, daily – taking off again – click to enlarge.

We are confident that the first thing readers will be curious to look for in Greenlight's latest just released first quarter letter is David Einhorn's take on his investment in the now bankrupt former hedge fund hotel, SunEdison. Einhorn's spares no self-criticism here: "SunEdison (SUNE) collapsed from $5.09 to $0.54. In January we negotiated with the company to add an independent director to the board. Unfortunately, and to our surprise, the patient was already in terminal condition.