Cycles, Bounces, & The Only Question That Matters

Submitted by Lance Roberts via RealInvestmentAdvice.com,

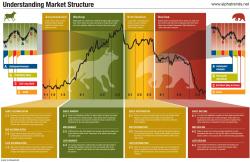

Market Cycles And Expected Outcomes

The “Visual Capitalist” website had a terrific market diagram explain the “best time to buy stocks.”

“Is it possible to time the market cycle to capture big gains?

Like many controversial topics in investing, there is no real professional consensus on market timing. Academics claim that it’s not possible, while traders and chartists swear by the idea.