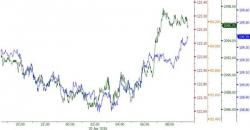

WTI Crude Spikes Above $42 As US Production Drops To 18-Month Lows

Following API's 3.1mm reported build overnight, expectations were for a 3mm build and DOE reported a 2.08mm build. Cushing saw a 235k draw from API and was expected to drop 1mm barrels but DOE reported just 248k drop in inventories as Gasoline inventories drewdown just 110k barrels (drastically less than the 1mm exp) and Distillates saw a large 3.55mm draw - the most in 3 months.