Witness the 95% Gross Profit on Recommended Oil Trade While Experts Await Higher Prices: I See A New Energy Paradigm

"Low oil price is a function of excessive supply+true demand realization" - Reggie Middleton

"Low oil price is a function of excessive supply+true demand realization" - Reggie Middleton

Submitted by David Stockman via Contra Corner blog,

Every day there is more confirmation that the casino is an exceedingly dangerous place and that exposure to the stock, bond and related markets is to be avoided at all hazards. In essence the whole shebang is based on institutionalized lying, meaning that prouncements of central bankers, Wall Street brokers and big company executives are a tissue of misdirection, obfuscation and outright deceit.

Submitted by Charles Hugh-Smith of OfTwoMinds blog,

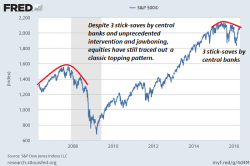

The battle boils down to what controls the market: central banks or fundamentals.

The tug of war between Bull and Bear has rarely been so clearly matched--and the stakes have rarely been so high.

Bulls are confident that central banks have their back in 2016. After all, whatever it takes has successfully pushed equities higher for seven years. Why not an eighth?

In the following video Abby Martin explores the former secretary of States close connections to Wall Street and large multinational corporations to reveal how the Clinton’s multi-million-dollar political machine operates. Hillary Clinton is not a candidate of the people….. she has been preparing for the role of CEO to ‘Big Money’ interests.

There was some hope that after a better than expected result from JPM and, to a lesser extent MS and WFC, that Goldman would surprise to the upside. That did not happen even though the company moments ago reported EPS of $2.68 beating expectations of $2.48, which nonetheless was a 55% plunge in earnings from a year ago.