![]()

See this visualization first on the Voronoi app.

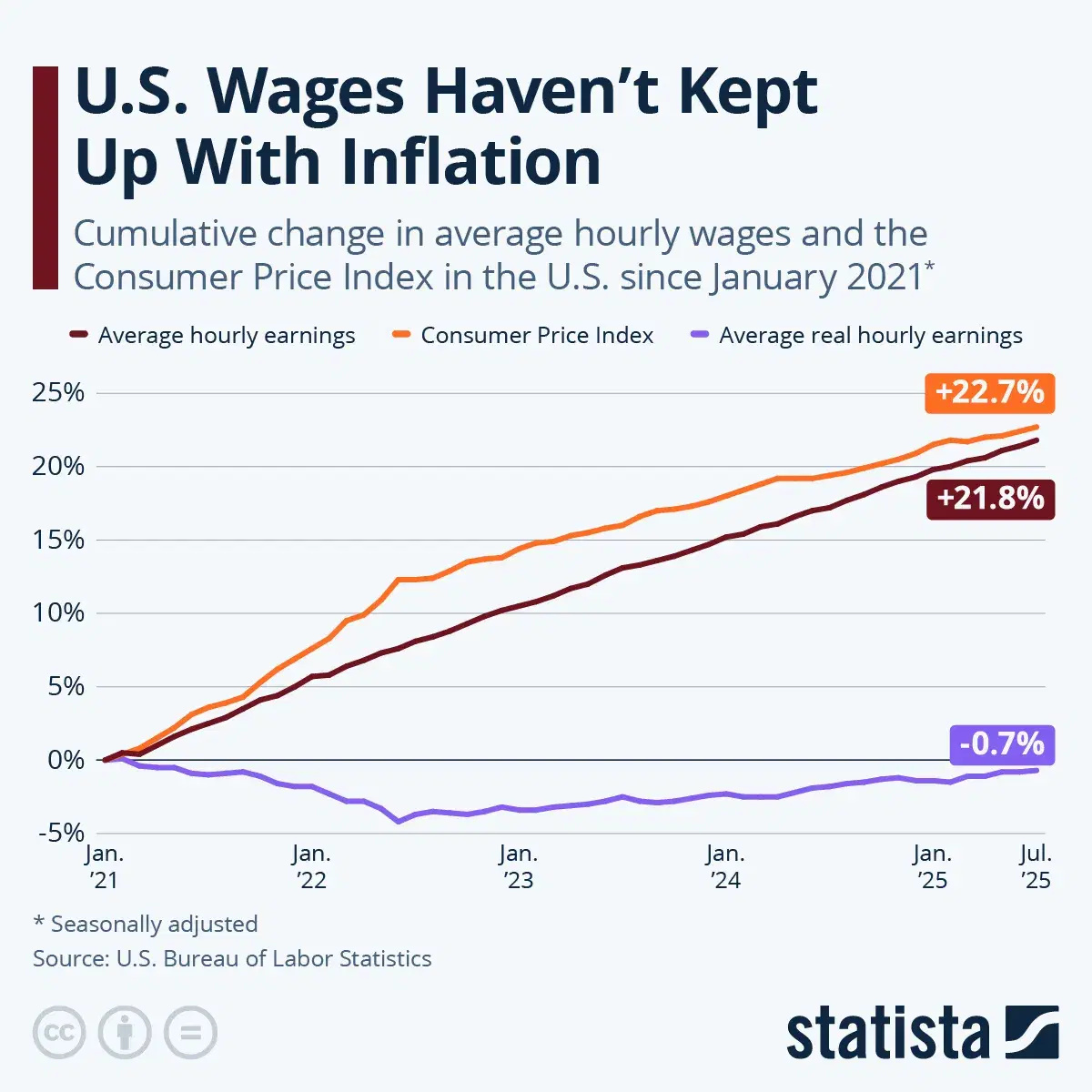

Charted: U.S. Wages vs. Inflation (2021–2025)

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

- Since January 2021, U.S. consumer prices have risen 22.7%, outpacing wage growth at 21.8%.

- Real hourly earnings are still down 0.7%, showing workers’ purchasing power has slightly declined over four and a half years.

- Nominal wage growth has outpaced inflation since May 2023, signaling a positive trend for real wages.

The post-pandemic economy has been a story of resilience on paper—low unemployment, strong GDP growth, and record-breaking stock markets. But for many Americans, the lived experience tells a different story. As inflation surged through 2021 and 2022, wages struggled to keep up, leaving households feeling squeezed despite broader economic gains.

According to data from the U.S. Bureau of Labor Statistics and visualized by Statista, average hourly earnings increased by 21.8% from January 2021 to July 2025. Meanwhile, the Consumer Price Index (CPI) rose 22.7% over the same period, leaving real wages—the amount adjusted for inflation—down 0.7% cumulatively.

Chart: How Wages Compare to Inflation

The above chart visualizes cumulative changes in wages and inflation over the last four and a half years, and is summarized by the data below:

| Indicator | Cumulative Change Since Jan 2021 (as of Jul 2025) |

|---|---|

| Average hourly earnings | 21.8% |

| Consumer Price Index (CPI) | 22.7% |

| Average real hourly earnings | -0.7% |

While wage growth appears strong in nominal terms, real earnings are still underwater. The most striking period was between April 2021 and April 2023, when inflation outpaced wage growth for 25 consecutive months, shrinking purchasing power month after month.

Since May 2023, there’s been a turnaround—nominal wages have once again outpaced inflation, causing real wages to rise. But that hasn’t been enough to fully recover from the inflation shock that began in 2021.

The Lingering Impact of Inflation

The -0.7% drop in real hourly earnings since January 2021 highlights a fundamental truth: even small mismatches between wage growth and inflation, when sustained over years, can erode financial stability for everyday Americans.

There is reason for optimism, though. If the current trend continues, with inflation stable and wage growth healthy, real wages could soon surpass pre-crisis levels. But that path remains vulnerable to shifts in inflation or labor market conditions.

Learn More on the Voronoi App

For a longer-term look at how wages and inflation have tracked historically, check out the data from 2007 in this USAFacts visualization on Voronoi.