The Fed Sends A Frightening Letter To JPMorgan, Corporate Media Yawns

Submitted by Pam Martens and Russ Martens via WallStreetOnParade.com,

Submitted by Pam Martens and Russ Martens via WallStreetOnParade.com,

The Fed is “one and done” for rate hikes.

We called this back in mid-2015. The US economy is far too weak for the Fed to engage in anything resembling a series of rate hikes. Corporate leverage, household leverage, even the national debt stand at levels that limit the Fed from hiking rates.

The Central Banking insiders know this. Which is why Former Fed Chair Ben Bernanke admitted in private luncheons with hedge fund managers that rates would not “normalize” in his “lifetime.”

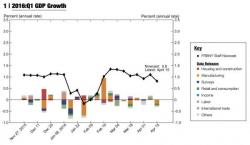

The New York Fed's 'decidedly-more-optimistic-than-Atlanta-Fed's-GDPNow-model' NowCast model for GDP growth just tumbled back to reality after a week of dismal data finally forced its hand. Treasury bond yields are extending their tumble as NYFed slashes Q1 growth to just 0.8% (from 1.5% in Feb) and collapsed Q2 growth to 1.2% from 1.9% last week. This cuts the entire H1 estimate from 1.5% to 1.0%... shamed down to GDPNow's reality.

Q1 cut...

And Q2 slashed...

And what drove the drastic cut...

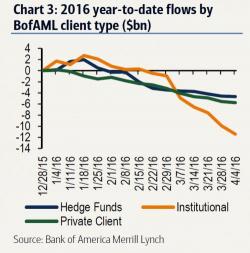

There has been some confusion in recent weeks about one unexplained aspect of the rising market: just who is buying?

The reason for the confusion is not only the previously documented buyer strike by the smart money (hedge funds, institutions and private clients), which as we reported a few days have sold stocks for 11 consecutive weeks.

Then last night, citing the latest EPFR data, BofA reported that retail equity investors are now also "risk-off" following $6.2 billion in equity outflows from all regions.

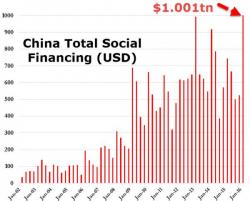

When China reported its economic data dump last night which was modestly better than expected (one has to marvel at China's phenomenal ability to calculate its GDP just two weeks after the quarter ended - not even the Bureau of Economic Analysis is that fast), the investing community could finally exhale: after all, the biggest source of "global" instability for the Fed appears to have been neutralized.