Have Oil Stocks Recovered Their "Line In The Sand"?

Via Dana Lyons' Tumblr,

A key index of oil stocks has moved back above its (temporarily broken) 30-year up trendline…for now.

Via Dana Lyons' Tumblr,

A key index of oil stocks has moved back above its (temporarily broken) 30-year up trendline…for now.

During a post-presentation Q&A in Chicago this morning, Atlanta Fed head Dennis Lockhart warned investors that Brexit is a notable risk and was a consideration within Fed policy meetings (along with every global nation's problems, we presume). However, it was his follow-up comment that has created notable chatter among the "mandate-driven","data-dependent" Fed watching community when he said that any Brexit issues "shouldn't stop the music" for The Fed.

Well, that didn't take long.

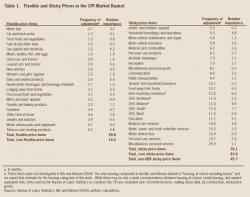

First the AtlantaFed (with occasional shoulder-tapping exceptions) created a mini revolt in the way GDP was tracked on a day to day basis with its GDP Nowcast, one which pressured the NY Fed to create its own version (influenced by Goldman's own economic models as the Atlanta Fed's number are seen as too pessimistic), and now the same Atlanta Fed is casting serious doubt over the government's official inflation numbers, with its own "sticky-price" CPI tracker.

Submitted by Jim Quinn via The Burning Platform blog,

The Census Bureau put out their monthly retail sales report yesterday morning. During good times, the MSM would be hailing the tremendous increases as proof the consumer was flush with cash and all was well with the economy. Considering 70% of our GDP is dependent upon consumer spending, you would think this data point would be pretty important in judging how well Americans are really doing.