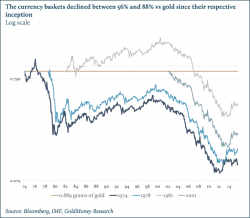

The IMF’s Special Drawing Rights, the RMB and gold

The IMF’s Special Drawing Rights, the RMB and gold

The full article with additional charts and tables is published

on GoldMoney.com can be downloaded

here.

The IMF’s Special Drawing Rights, the RMB and gold

The full article with additional charts and tables is published

on GoldMoney.com can be downloaded

here.

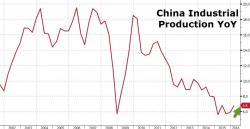

Heading into tonight's datagasm from China, SHCOMP tumbled and Yuan was strengthening (while money-market rates were ticking higher). Then it began... Retail Sales BEAT (+10.5% vs. +10.4% exp), Industrial Production BEAT (+6.8% vs. +5.9% exp), Fixed Asset Investment BEAT (+10.7 vs. +10.4% exp) and last - but not least - GDP MEET (+6.7 vs. +6.7% exp) - though still the weakest since Q1 2009. The post-data reaction was initially opsitive but then faded fast as reality hit on the lack of stimulus coming.

As the world is now fully aware, The BOJ surprised markets in January when it set a –0.1% rate on some deposits that banks place at the central bank, effective from mid-February. Its move was designed to encourage banks to lend more, spurring higher spending and inflation. Things are not working so well...

And now, as The Wall Street Journal reports, some are already doubting the policy...

Submitted by Peter Schiff via Euro Pacific Capital,

Russian combat equipment used in Syria did have many drawbacks but the successful mission by the Russian Aerospace Troops has helped increase arms exports. During an annual televised Q&A session president Vladimir Putin vowed to examine the many drawbacks that had surfaced in the operation of Russian combat equipment in Syria. “I shall be honest, there are many of them. Everything is now carefully being examined by experts.“ Putin mentioned that demand for Russian weapons have increased worldwide forcing the opening of new manufacturing plants, putting Russia second behind the U.S.