In Its Second Attempt At Going Public, BATS Prices $253 Million IPO At $19/Share

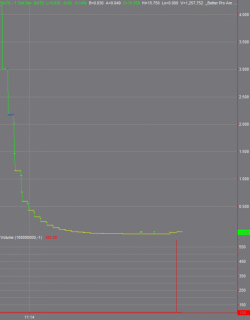

Just over four years ago, on March 23, 2012, every HFT's favorite exchange (because it specifically affords them a look at incoming order flow as described by Michael Lewis in Flash Boys), BATS Global Markets, IPOed at a price of $16/share (the low end of the range), valuing the company at around $760 million. However, it was not the pricing that was memorable, but what happened later that day when the stock tried to break for trading. As we reported back then, after its first print at $15.75, the stock proceeded to collapse to just above $0 in about 900 milliseconds.