Doha Deal "Hope" Sparks Biggest Stock Short-Squeeze In 2 Months

So a done deal became "hope for a deal" for a freeze at record production levels amid The IMF slashing global growth (and thus demand) expectations... and this happened...NOTE - all momentum faded when NYMEX closed

Your annotated day...

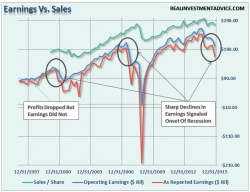

Kinda makes you wonder...