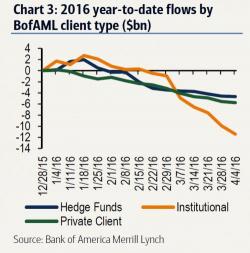

"The Selling Just Won't Stop" - Smart Money Sells Stocks For Near Record 11th Consecutive Week

Last week when BofA reported that "everything is being sold" as its smart money clients (institutional, private and hedge funds) dumped stocks for a whopping 10th consecutive week, it said that "BofAML clients were net sellers of US stocks for the tenth consecutive week, in the amount of $3.98bn. Net sales last week were the largest since September, and the fifth-largest in our data history (since 2008). Since early March, all three client groups (institutional clients, private clients and hedge funds) have been sellers of US stocks."