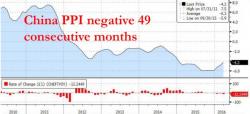

China CPI Misses, Drops Sequentially As PPI Declines For 49 Consecutive Months

There was some good and some bad news in tonight's Chinese March inflation (and deflation in the case of PPI) data.

The good news, for those who believe that rising inflation is a positive economic outcome, was that Producer Prices declined "only" 4.3% Y/Y, or less than the -4.6% exoected, and better than the -4.9% drop last month. On a sequential basis, PPI rose by 0.5% on the back of various commodity input prices posting a modest increase in the past month on the back of China's epic January loan injection.