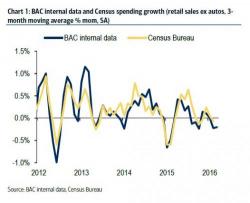

Consumer Spending Falls Again In March According To Latest Credit Card Data

While big banks blame the collapse in Q1 GDP on "residual seasonality" (more on that later), with BofA recently slashing its Q1 estimate from as much as 2.7% to just 0.2%, the reality is that something is not well with the US consumer. The latest proof of this comes from the most recent Bank of America credit and debt card spending data, which reveals that sales were once again down 0.1% yoy.