Triffin's Paradox Revisited: Crunch-Time For The U.S. Dollar & The Global Economy

Submitted by Charles Hugh-Smith of OfTwoMinds blog,

The reality is that we're one panic away from foreign-exchange markets ripping free of central bank manipulation.

Submitted by Charles Hugh-Smith of OfTwoMinds blog,

The reality is that we're one panic away from foreign-exchange markets ripping free of central bank manipulation.

The following list, according to Goldman Sachs, shows 50 stocks that most frequently appear among the largest 10 holdings of hedge funds. Spot the top one.

After today's absolutely slaughter of Allergan, we expect the Goldman Hedge Fund VIP basket, whose constituents this table shows, to be absolutely obliterated.

For all those who are sitting on pins this morning (and there are many), following every twist in the ongoing drama involving what until yesterday was supposed to be the biggest M&A deal of the decade, we have some news. Moments ago Reuters blasted that:

The stock promptly sold off. And then, not even 5 minutes later, Bloomberg blasted the following:

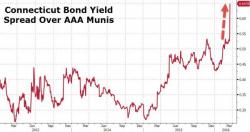

Over the past several months, the recurring story of hedge fund billionaires taking leave their home states, and heading to tax-friendly Florida has led various pundits to focus on the deteriorating fiscal state of hedge-fund heavy Connecticut, where as we reported recently credit risk surged to record highs following a disappointing bond auction.

Looks like this rally has ended.

The S&P 500 has run into the downward sloping trnedline set by the 2015 top. It has since rolled over. We’re likely heading down in a big way.

Investors forget, the sharpest, most aggressive rallies occur during bear markets. This is because bear market rallies are driven by short-covering: those investors who went short are forced to “cover” or buy back shares they have sold previously.

Consider the Tech Bubble.