Is Market Breadth Beginning To Sour?

Via Dana Lyons' Tumblr,

Despite positive action in the major averages, market breadth has very recently begun to lag.

Via Dana Lyons' Tumblr,

Despite positive action in the major averages, market breadth has very recently begun to lag.

Thanks to an ever-increasing need for tax revenues to fund an ever-increasing horde of government-handout-beneficiaries, the populist-in-chief has once again taken aim at tax inversions for the crusade-du-jour. We look forward to him explaining how this is different (and better for American jobs) from what Donald Trump has suggested.

As AP reports,

President Barack Obama will speak from the White House about new rules aimed at deterring "tax inversions."

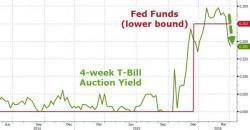

Moments ago the US Treasury priced its 4 Week Bill auction, which was unique in that at just $35 billion, was not only $10 billion lower than a month ago, but was the lowest since October 15.

This may or may not explain why after last week's curious auction yield of 0.20%, or 5 bps below the effective Fed Funds floor, today's auction showed an even more dramatic scramble for short term liquidity, when the government sold 4 Week Bills at a rate of 0.185%, or 6.5 bps below the rate charged by the Fed!

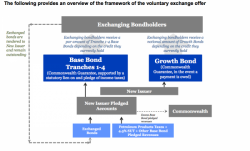

The ongoing feud between Puerto Rico and its mostly hedge fund creditors is promptly shaping up as the next "Argentina", where "vulture investors" may well end up holding the island commonwealth hostage for years, during which time, however, they won't get paid.

We're gonna need a bigger bailout...

Just when you thought it was safe to catch a falling knife and that all the systemic fears in the world had been washed away by coordinated central bank manipulation, this happens...

Deutsche Bank stock price is retesting record lows as - just like Lehman - all the soothing words merely enabled a dead-cat-bounce to let some 'insiders' out with less pain.

As Deutsche itself notes: What explains the weakness in banks?