Worst Case Scenario: 73% Down From Here

Submitted by Jim Quinn via The Burning Platform blog,

Submitted by Jim Quinn via The Burning Platform blog,

Having glad-handed with President Obama just this morning, and complained of a "sluggish global economy," that ironically his credit-fuelled mal-investment maelstrom enabled via its deflationary forces, Chinese President Xi appears to have moved on from currency wars to protectionism as WSJ reports China is tightening its grip on cross-border e-commerce, imposing a new tax system on all overseas purchases.

Several days ago, we explained how China's bizarro M&A scramble was nothing more than a rushed attempt to park as much capital in the US (and offshore) as possible before Beijing gets wise enough and cracks down on this latest loophole to evade Chinese capital controls, we had this to say about the farcical, and now pulled, $14 billion Anbang offer for Starwood, owner of the W Hotels, Sheraton and St Regis brands:

Having bounced miraculously off the early January lows - despite no significant fundamental shift - scrambling all the weay up to its 200-day moving-average, copper prices have been tumbling for the last 7 days, the longest losing streak since early Jan. "Worries over Chinese demand is still weighing on the market," warns one analyst and rightly so as, just like the oil complex, copper inventories (in China) just hit a record high.

Miracle ramp...

Is fading now as stockpiles soar...

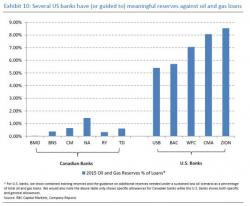

Roughly around the time the market troughed in early February, we asked "After The European Bank Bloodbath, Is Canada Next?" The reason for this question was simple: we said that "when compared to US banks' (artificially low) reserves for oil and gas exposure, Canadian banks are...not."

Stated otherwise, we warned that the biggest threat facing Canada's banking sector is how woefully underreserved it is to future oil and gas loan losses.