Yellen-Driven Short-Squeeze Sends Bonds To Best Quarter In 4 Years

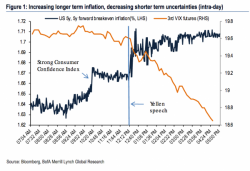

After The Fed jawboned the world into the largest aggregate net short position in Treasuries in Q4 since 2010, its rapid realization that all is not well in the real world - and subsequent talking (and walking) back of rate-hike expectations - has sparked the biggest short-squeeze in 6 years and sent Treasuries up by the most since 2012. With odds collapsing for any more rate-hikes in 2016, as Yellen admits their forecasts are worthless, it seems - just as in 2010 - the bonds shorts have a way to go.