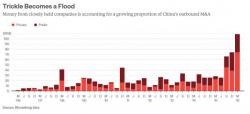

8 Things The Chinese Are Scrambling To Buy In America

There has been some confusion in recent months about the unprecedented M&A buying spree unleashed by Chinese investors on international, but mostly U.S. targets, a spree which has already resulted in a record amount of Chinese outbound M&A capital, manifesting in $41 billion in US deals in just the first quarter, already double the full amount for 2015...

... funded by just as ridiculous amounts of debt: