The "Restaurant Recovery" Is Over: Casual Dining Sales Tumble For Fourth Straight Month

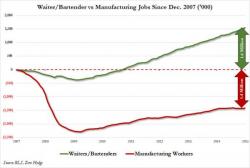

While the US manufacturing sector has been in a clear recession for the past year as a result of the collapsing commodity complex, so far the stable growth in low-paying service jobs - at least according to the BLS' statistical assumptions - such as those of waiters and bartenders have kept the broader service economy out of contraction (even though recent Service PMI data has been downright scary).

This is now changing: as we showed a month ago, according to the lagged effect of the collapse of the Restaurant Performance Index, that party is over: