The Biggest Short

Authored by StraightLineLogic.com's Robert Gore via The Burning Platform blog,

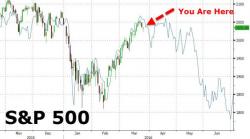

Some reversals of financial trends prove so momentous they define the generation in which they occur. The stock market crash in 1929 kicked off the Great Depression, which ushered in the welfare and then the warfare state and redefined the relationship between government and citizens.