30Y Treasury Yield Tumbles, Signals Trouble Ahead For Banks

Safe haven buying is ignoring precious metals and piling into bonds today with the long-end notably outperforming (-6bps) today. This has compressed the yield curve even more, putting more and more pressure on the "rate-hike environment" hopers who bought banks like they were told...

This has compressed 2s30s below the "Dimon Bottom"

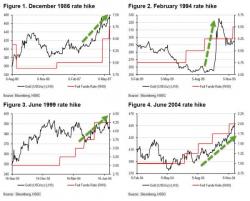

Fool me three times?