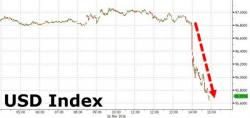

Goldman FX Head: "No Central Bank Conspiracy" To Crush The Dollar

Anyone having listened, and traded according to the recommendations of Goldman chief FX strategist Robin Brooks in the past 4 months, is most likely broke. First it was his call to go very short the EURUSD ahead of the December ECB meeting, which however led to the biggest EURUSD surge since the announcement of QE1. Then, two weeks ago, ahead of the ECB meeting he "doubled down" on calls to short the EUR ahead of the ECB, the result again was a EUR super surge, the biggest since December.