Chevron Protects Dividend, Slashes Another 36% Off Spending

Submitted by Nick Cuningham via OilPrice.com,

The largest oil companies are struggling to balance competing objectives with dramatically lower revenues compared to previous years.

Submitted by Nick Cuningham via OilPrice.com,

The largest oil companies are struggling to balance competing objectives with dramatically lower revenues compared to previous years.

Just two months ago, former Fed President Dick Fisher admitted that "The Fed front-loaded an enormous market rally in order to create a wealth effect." Today he is back, taking a victory lap onthe 7th anniversary of the crisis lows by explaining, rather stunningly, to CNBC that "we injected cocaine and heroin into the system" to enable a wealth effect (that he admits did not work, despite its success in raising asset prices), and "now we are maintaining it with ritalin." Fisher also confirmed his previous warning that "The Fed is a gian

While most western central bankers are slowly, if grudgingly, admitting that everything they have done since the start of the "most hated rally in history" has been to create precisely this rally (also explaining why it remains so deeply "hated" as none of it is in any remote way natural) at least in Hungary they are dead honest from the onset, that when it comes to propping up the economy it all starts (and ends) with the stock market.

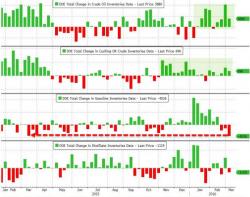

DOE's 3.88mm inventory build confirms API's print and is the 8th weekly rise in the last 9 for overall crude levels. Cushing also saw a build (690k) -- the 17th week of the last 18. But the market - for now - is focused on the 4.5mm barrel draw in gasoline inventories - the biggest in a year, as the seasonals pickup. Crude jumped on the news, seemingly ignoring the fact that Cushing inventories now stand at a record high 66.9mm barrels. Also notably, US production rose for the first time in 7 weeks.

DOE:

Worst.Case.Scenario. In 24 years, the ratio of wholesale inventories to sales has only been higher than the current 1.35x once - at the peak of the recession in the last financial crisis. Wholesale sales tumbled 1.3% MoM (worse than the -0.3% exp) and inventories rose 0.3% MoM while expectations were for a drop of 0.1% (inventories over sales difference rose from $143.6BN to $151.2BN in one month, a new record high.) And finally, automotive inventories rose to 1.78x sales - the highest since the crisis.