Sudden Plunge In Japanese Government Bonds Triggers Circuit Breaker, Halts Market For 30 Seconds

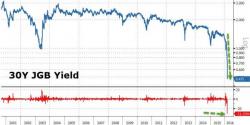

It was just yesterday when we observed the record collapse across the Japanese curve when first the 10Y JGB plunged to an all time low -0.10%, followed promptly by 30Y yields dropping 21bps - the biggest absolute drop in over 3 years and biggest percentage drop ever - to a record low 47bps following Japan's 30Year auction on Monday night. As we further noted, since Kuroda unleashed NIRP, the entire JGB curve has been crushed and the Monday night rush for long duration debt flattened the curve to record lows.

What a difference a day makes.