Kroger And Walmart Try More Gimmicks To Thwart Amazon; They Will Fail...Again

Over the summer, we argued that the grocery business in the U.S. is, and always has been, a fairly miserable one. From A&P to Grand Union, Dahl's, etc., bankruptcy courts have been littered with the industry's failures for decades.

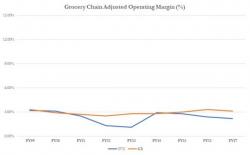

The reason for the persistent failures is fairly simple...razor-thin operating margins that hover around 1-3% leave the entire industry completely incapable of absorbing even the slightest financial shock from things like increasing competition and food deflation.