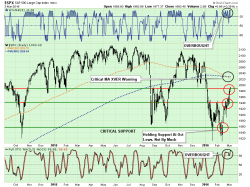

Weekend Reading: Is The Bear Market Over Already?

Submitted by Lance Roberts via RealInvestmentAdvice.com,

“The Bear Market Is Dead, Long Live The Bull.”

You could almost hear the chants from the always bullish biased media this week as the markets ripped higher on “first day of the month” portfolio rebalancing and short-covering by fund managers.

The rally, as discussed this past weekend, was not unexpected: