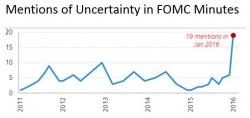

The Only Chart That Matters For The Fed In March

"Uncertainty" exploded in January for The Fed, and after today's "great" (surging job gains) and "terrible" (plunging wages) jobs data (as well as surging current inflation and plunging inflation expectations), we can only imagine Yellen will be even more confused at March's meeting.

Source: @Not_Jim_Cramer

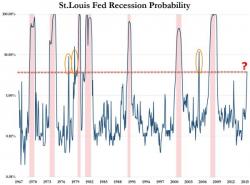

Time for a stock market selloff to force The Fed to back off its tightening bias once again...

With Dec rate hike odds now above 70%...