3 Things: Recession Odds, Middle-Class Jobs, & Market Drops

Submitted by Lance Roberts via RealInvestmentAdvice.com,

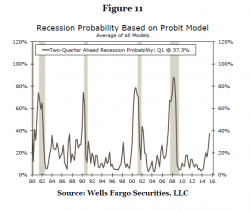

Recession Probabilities Rise

As I penned earlier this week:

Submitted by Lance Roberts via RealInvestmentAdvice.com,

Recession Probabilities Rise

As I penned earlier this week:

Before his presentation to the University of Texas, Bridgewater's Ray Dalio gave a far-ranging interview to Bloomberg's Erik Shatzker which we will have more to say about in the coming days, but the overarching theme was what to expect from markets going forward. He said that while there are "asymmetric" risks to the downside, asset prices will correct to a point where risk premiums return and investors come back, and predicted that equities will return about 4% in the long term.

For the first time since the highs in 2011, Spot Gold has entered a bull market. Now up over 21% from the early December lows, Gold is trading at 13-month highs and outperforming all other asset classes amid the descent into negativity by global central banks...

Charts: Bloomberg

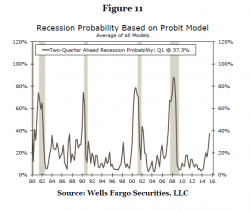

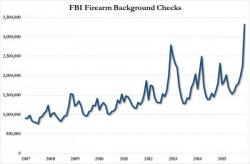

Two months ago we presented what we thought was a "very troubling"chart, one showing the latest data on FBI background checks, a proxy for gun purchases. The chart had just hit an all time high.

Since then, the progression has escalated and gun sales have continued to soar as the following update showing gun sales for the month of February over the past decade:

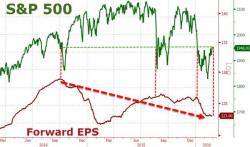

The S&P 500 is trading around 1950. It has traded at that level numerous times in the last 18 months.

During that time, consensus earnings expectations for the S&P 500 have plunged...

In fact - since the start of the year - when stocks were at exactly this level, earnings expectations have tumbled almost 3% non-stop??

It appears the mother's milk of markets is rapidly drying up.