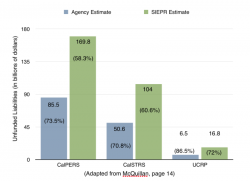

The Tragedy Of California's Public Pensions

Submitted by C. Jay Engel via The Sullivan Group,

Submitted by C. Jay Engel via The Sullivan Group,

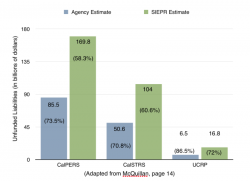

It's probably nothing...

Charts: Bloomberg

The key (recurring) catalyst for today's early spike in oil, was the latest desperate attempt by an imploding OPEC member, this time Nigeria to push oil higher when overnight its petroleum minister Emmanuel Kachikwu said that key members of OPEC intend to meet with other producers in Russia on March 20 to renew talks on an agreement to cap oil output, Nigeria’s petroleum minister said.

The headlines in question:

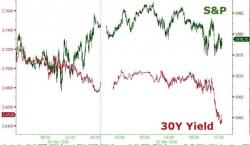

Two weeks ago, we looked at what is perhaps the best coincident indicator of the true, not-seasonally adjusted, picture of the US labor market, namely withholdings of income and employment taxes. We reported that while for most of 2015, tax withholdings rose at a rate of 5% or more from a year ago, on the back of job growth and gains in wages, commissions and other incentive pay, in recent months there has been a substantial dropoff in this key indicator.

Following yesterday's modest drop in US crude production and yuuge build in inventories, headlines about possible Venezuela meetings sent algos into panic-buying mode. This morning the headlines are from Nigeria, whose Petroleum Minister "expects a dramatic price move" claiming a meeting between OPEC and NOPEC will happen on March 20th. Combine that idiocy with significant US Dollar weakness this morning and the surge in Oil ETF share creation and the perfect storm of higher prices in oil (as hedgies pile in).