Things Have Actually WORSENED Since the Feb Bounce Began

What a different four weeks makes.

Four weeks ago, the S&P 500 had just taken out critical support. Everyone was panicking that the market was about to implode.

1. At that time, China was continuing to devalue the Yuan as its economy collapsed.

2. Europe was tumbling based on Draghi’s inability to generate inflation.

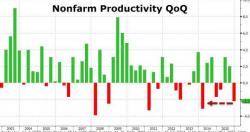

3. The US economy was rolling over sharply as deflation arose courtesy of US Dollar strength and a Fed rate hike.