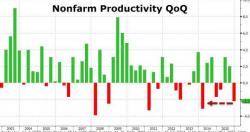

The Ongoing Plunge In American Worker Productivity Explained

While revised modestly higher from preliminary levels, US non-farm productivity plunged 2.2% in Q4 2015 - the biggest drop since Q1 2014.

Economists are gnashing their teeth to explain this "plunging productivity paradox" - we think it is rather simple...

While only modestly tongue in cheek, here is what is really going on...