Zombie Corporations: Over 10% Of Global Companies Depend On Cheap Fed Money

Authored by Mike Shedlock via www.themaven.net/mishtalk,

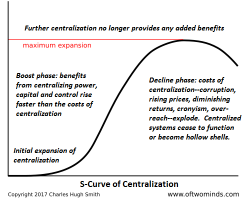

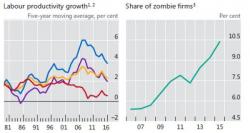

Ten percent of corporations survive only because central banks have kept real interest rates negative.

The BIS defines Zombie firms as those with a ratio of earnings before interest and taxes to interest expenses below one, with the firm aged 10 years or more.

In simple terms, Zombies are those firms that could not survive without a flow of cheap financing.