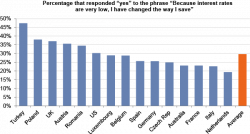

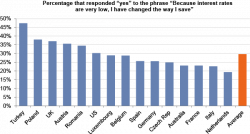

What Savers Do Under NIRP - The "Perversely Negative" Impact Of Going Negative

Authored by Mark Cliffe, originally posted at VoxEU.org,

Authored by Mark Cliffe, originally posted at VoxEU.org,

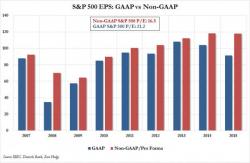

After the recent sharp spike higher in the S&P which has pushed it 150 points off its lows, the market may be down 3% since the beginning of the year. However, while many have blamed the 2016 selloff and subsequent rebound on central bank policy confusion, what many are forgetting is that a key factor pushing stocks lower are corporate earnings. And, as JPM reminds us, even with stocks 3% lower for the year, the overall market is more expensive now than it was at the start of the year.

Following last night's yuuge inventory build reported by API (+9.9m) and large rise in Cushing levels (+1.8m), DOE reported a crude build of even yuuger 10.37mm barrels (against the 7.1mm expectation) - the largest since early April 2015. Cushing saw a 1.2mm build - the most in 3 months.

Authored by Prof. Steve H. Hanke of The Johns Hopkins University. Follow him on Twitter @Steve_Hanke.

Ever since General Sisi ousted the Muslim Brotherhood, the Egyptian economy has remained in shambles. Businessmen are fed up. They are ignoring government gag orders, and are making their voices heard. And why not? They are losing sales, missing deadlines, and scrapping expansion plans because of limited access to U.S. dollars.

It’s not entirely clear whether Saudi Arabia knew what they were setting in motion when the kingdom moved to deliberately suppress crude prices at the end of 2014.

The idea (of course) was to preserve market share by bankrupting the US shale space and if there were “ancillary benefits” - like say forcing Moscow to give up its support for Bashar al-Assad - well then all the better.