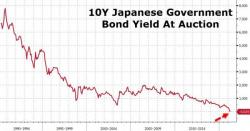

As we detailed earlier, for the first time in the history of crazy, Japan 'sold' 10-year government bonds today at a negative yield. Translated into English, this means "investors" agreed to pay the Japanese government 2.4bps per year for the privilege of lending it money for 10 years...

Down from a 7.8bps positive yield at the last auction, the 10Y auction's average yield was -2.4bps...

Peter Pan(ic) continues as the rest of the JGB curve collapses to fresh record low yields and await the reaction in Japanese bank stocks...