China's Housing Bubble Is Back: Locals Wait In Line For Days To Flip Houses

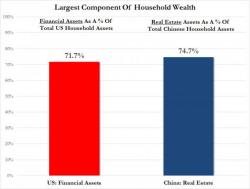

Back in early 2014, we warned that the Chinese housing bubble has burst, promptly followed by official confirmation by China's National Bureau of Statistics which showed that in the subsequent several months Chinese home prices and transactions plunged. Since then, however, China - whose economy has been on a steep downward spiral - has desperately scrambled to reflate this most important to its economy bubble, because as a reminder in China three quarters of all household assets are in Real Estate...