You Might Be A Tech Company If...

Via ConvergEx's Nicholas Colas,

It happens at the top of every tech cycle – everyone wants to be a tech company. We’re there now.

Via ConvergEx's Nicholas Colas,

It happens at the top of every tech cycle – everyone wants to be a tech company. We’re there now.

Earlier today, we noted that Citi can’t believe how enticing CLO mezz tranches have become.

“Can CLO mezz get any more attractive?” the bank’s structured credit team asked. You’d be forgiven for being a bit incredulous. After all, CLO 2.0 mezz hasn’t exactly been somewhere you want to be. As Morgan Stanley noted last week, “the median total return for US CLO 2.0 (2014-15 vintage) BBs is -9.2%, and for single-Bs is -20.9%.”

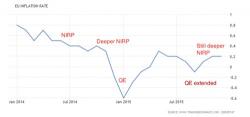

In the last month, we’ve had two major confessions from Central Bankers.

We’ve already detailed the first, which came from the Head of the Bank of Japan, Haruhiko Kuroda here.

The second major confession from a Central Banker came from ECB President Mario Draghi. A few days ago, Draghi gave a speech in which he said:

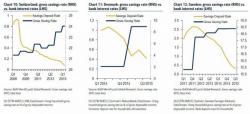

Back in August 2012, when negative interest rates were still merely viewed as sheer monetary lunacy instead of pervasive global monetary reality that has pushed over $6 trillion in global bonds into negative yield territory, the NY Fed mused hypothetically about negative rates and wrote "Be Careful What You Wish For" saying that "if rates go negative, the U.S.

Brave Vladimir Putin is pushing for a gold-backed currency, ditching fractional reserve banking, and delivering a defiant rebuke to the Western world’s move towards a digital-only cashless society, according to a report circulating in the Kremlin on Friday. President Putin swears he will NEVER stop the circulation of cold hard cash because he considers digital-only cashless currency to be a New World Order tactic to gain control over the public.