This Is The Reason For Today's Nat Gas Surge

It had been a volatile day for nat gas traders.

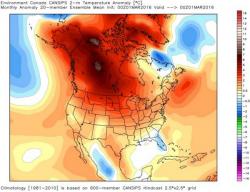

As we reported this morning citing Bloomberg, "it’s almost time to put that snow shovel away and get out the gardening tools", because as the following weather forecast shows, March temperatures are expected to be considerably higher than expected across the entire US.

This led to some abnormal moves in natgas this morning:

The moves even prompted rumors that another commodity hedge fund had blown up: